|

Track Your Trades 2020.1

Last update:

Mon, 3 May 2021, 6:00:02 pm

Submission date:

Tue, 3 March 2009, 6:23:52 pm

Vote for this product

Track Your Trades description

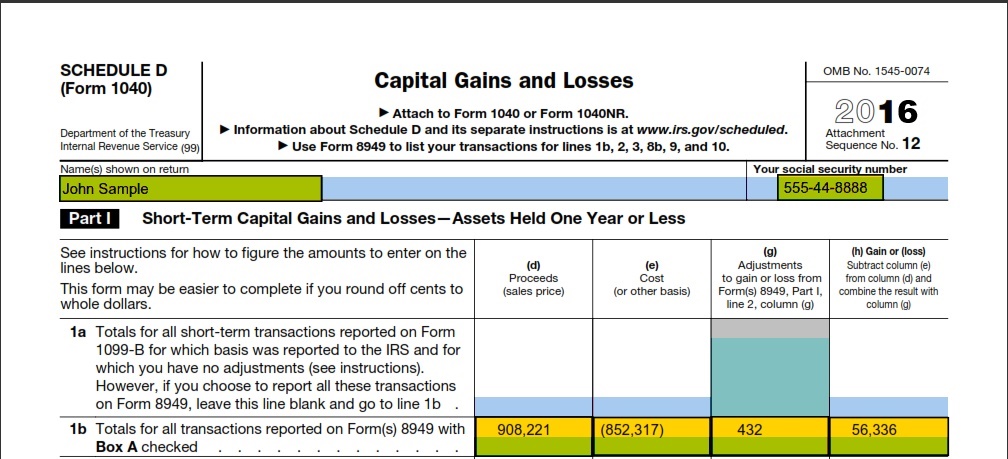

Generate Schedule D for your tax returns. Practical, yet powerful trader tools!

Track Your Trades (TYT) simplifies completion of the otherwise tedious federal Schedule D (Capital Gains and Losses) tax form. Created for investors, traders, and tax professionals, TYT supports stocks, options, mutual funds, short sales, wash sales, FIFO cost basis, LIFO cost basis, Specific Shares cost basis, equity type filtering, and password protection. Users can either print the Schedule D report for mailing, or export it to TurboTax, H&R Block Tax Software, TaxAct, or Excel for e-filing. Trades can be manually entered, or imported via a CSV file downloaded from TD Ameritrade, E*Trade, Fidelity, Schwab, or similar online brokerage. TYT stores trades from one or more brokerage accounts in a single consolidated file, allowing easier tax reporting from your PC or laptop. TYT also contains tools to support tax planning, including a What-If Wizard, which helps users find opportunities for strategic tax-loss selling. Now with Internet features, transaction detail reporting, enhanced import capability, and Form 4797 for Mark-to-Market traders. Requirements: 20 MB free space on hard drive; 256 MB RAM What's new in this release: Provides update to SEC Sales Fee rate Tags: • IRS • schedule d • tax return • trades • investing • portfolio • finance • stocks • options • form 8949 • stock market • form 4797 • mark-to-market Comments (2)

FAQs (0)

History

Promote

Author

Analytics

Videos (0)

|

Contact Us | Submit Software | Link to Us | Terms Of Service | Privacy Policy |

Editor Login

InfraDrive Tufoxy.com | hunt your software everywhere.

© 2008 - 2026 InfraDrive, Inc. All Rights Reserved

InfraDrive Tufoxy.com | hunt your software everywhere.

© 2008 - 2026 InfraDrive, Inc. All Rights Reserved