|

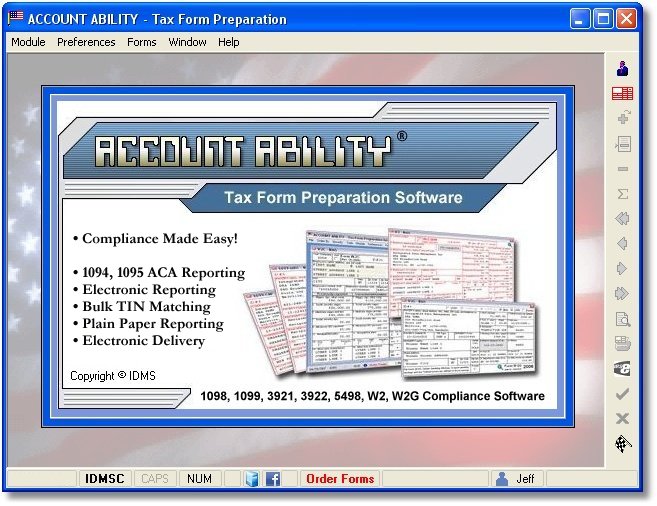

Account Ability Tax Form Preparation 28.00

Last update:

Fri, 19 June 2020, 6:00:03 pm

Submission date:

Wed, 16 November 2011, 3:00:07 pm

Vote for this product

Account Ability Tax Form Preparation description

IRS 1094, 1095, 1098, 1099, 3921, 3922, 5498, W2G, W2, W2C Compliance Made Easy

Account Ability prepares information returns (1094, 1095, 1098, 1099, 3921, 3922, 5498, W-2G) and annual wage reports (W-2, W-2C) electronically, on laser, inkjet and generic dot matrix printers. Returns can be keyed in or imported from Excel, IRS Pub. 1220 compliant transmittals, SSA EFW2 compliant transmittals and delimited text files. The Import Mapping Utility, which is included at NO EXTRA CHARGE, facilitates the job of importing comma, tab, and pipe delimited text files. IRS and SSA copies can be printed or electronically filed via IRS FIRE, IRS AIR (ACA), and SSA Business Services Online. Recipient copies can be printed on preprinted forms, plain paper, PDF and pressure seal forms. The Account Ability Forms Division carries a complete line of tax forms and companion envelopes. Tags: • ACA • 1094 • 1095 • 1095-B • 1095-C • 1098 • 1098-C • 1098-T • 1099-B • 1099-C • 1099-DIV • 1099-G • 1099-INT • 1099-K • 1099-MISC • 1099-R • 1099-S • 3921 • 3922 • 5498 • W-2 • W-2G • W-2C • EFILE • TIN Matching Comments (0)

FAQs (0)

History

Promote

Author

Analytics

Videos (0)

|

Contact Us | Submit Software | Link to Us | Terms Of Service | Privacy Policy |

Editor Login

InfraDrive Tufoxy.com | hunt your software everywhere.

© 2008 - 2026 InfraDrive, Inc. All Rights Reserved

InfraDrive Tufoxy.com | hunt your software everywhere.

© 2008 - 2026 InfraDrive, Inc. All Rights Reserved